Executive Summary

Three frontier AI models independently analyzed Quantom's technology and business potential, revealing consensus on key risks and opportunities while surfacing critical disagreements that illuminate the path forward.

What We Did

Independent Multi-Model Analysis

We fed identical documents from Quantom's data room into three independent frontier AI models:

- Claude Opus 4.6 — Business strategy + integration thesis

- Gemini Deep Think — Hard science skeptic, first-principles physics

- GPT-5.2 Pro — 31 minutes of reasoning, constructive skeptic with citations

The models were NOT told what the others concluded. The disagreements reveal where the real insight lives.

Key Finding

Quantom Is A Hypothesis, Not A Product

All three models converged on this assessment from Quantom's internal documents. The management team's honesty is a green flag — the question is whether the science can catch up to the vision.

Where All Three Models Agree

When three frontier models independently converge, pay attention. These consensus findings represent the highest-confidence assessments.

Gate 1 Is Everything

Mechanism proof on gold is the only thing that matters right now. Everything else — market strategy, Tractor Beam, 40+ materials, carbon credits — is contingent on demonstrating reproducible off-seed propagation under controlled conditions.

Battery Additive Beachhead

The MWCNT battery additive strategy is the smartest commercial move. Real market (EV battery demand 4.5× by 2030), existing buyer demand, and CNTs occupy a genuine performance sweet spot.

Patent Deadline Crisis

April 3, 2026 (~7 weeks) is urgent. Non-provisional/PCT must be filed or priority is lost. The IP is only as strong as the enabling data behind it — currently "prophetic."

DSP Hidden Killer

Downstream purification could kill the economics. The cost of cleaning aqueous electrochemical output to battery-grade purity could dominate COGS.

Copper Cliff

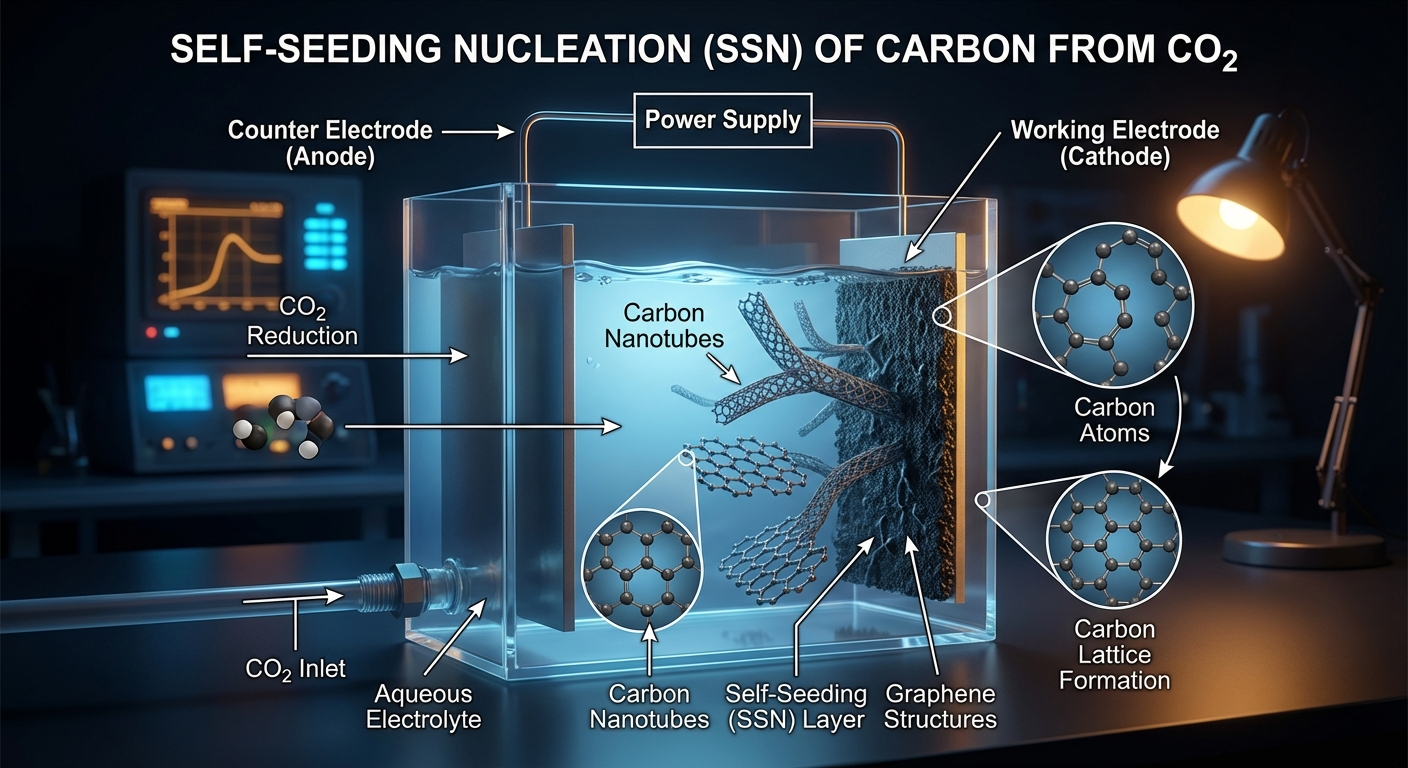

If SSN only works on gold/noble substrates, the economics don't support battery additives. The "Copper Cliff" must be crossed. No copper = no beachhead.

AI Integration Natural Fit

SSN is a parameterizable control problem (seed + pulse recipe → morphology). Perfect for Bayesian optimization. But AI cannot break thermodynamics — it accelerates discovery OR falsification.

Where the Models Disagree

The disagreements between models surface nuances that no single analyst would catch. This is where the gold is.

SSN Scientific Plausibility

Resolution: The ¹³CO₂ isotopic labeling test (GPT's recommendation) resolves this definitively. If ¹³C appears in the solid product, the carbon came from CO₂.

Tractor Beam Feasibility

Recommendation: Treat Tractor Beam as a long-term R&D asset, not a near-term product. Focus all energy on SSN + battery beachhead.

Cross-Model Comparison Table

A comprehensive view of how each AI model assessed key aspects of the Quantom opportunity.

| Finding | Opus 4.6 | Deep Think | GPT-5.2 Pro |

|---|---|---|---|

| SSN Plausibility | "Unproven, needs Gate 1" | "Borders on thermodynamic impossibility" | "Not impossible but extraordinary" — cites Nature Comms precedent |

| Internal Doc Consistency | Not flagged | Not flagged | RED FLAG: Q1 2025 vs Dec 2025 timeline conflict |

| Off-seed Mechanisms | General risk | Adatom mobility wall | Three specific mechanisms + contamination as most likely |

| Tractor Beam | Noted challenges | "Science fiction" | "Not crazy" — cites ACS literature. Manufacturing ≠ physics demo. |

| Isotopic Labeling (¹³CO₂) | Not suggested | Not suggested | "Murders the contamination objection" |

| Investment Structure | Full acquisition | $30K Tranche A only | Option-to-acquire with milestone holdbacks |

| Tone | Business-balanced | Hard bear | Constructive skeptic |

Five Highest-Impact Actions

Synthesized from all three models, ranked by leverage for the next 7 weeks.

Run Gate 1 With Critical Additions

Execute exactly as December 2025 memo specifies, plus GPT-5.2 Pro's recommendations:

- ¹³CO₂ isotopic labeling — proves carbon in product came from CO₂, not contamination

- Mass balance / faradaic efficiency to solids — quantifies how much carbon becomes product vs gas/liquid byproducts

Pre-Register Controls Before Running Experiments

GPT laid out specific matched controls to prevent post-hoc goalpost shifting:

- CO₂ vs N₂/Ar (same everything else)

- Seeded vs no-seed (same pulsing)

- Pulsed vs DC (same average current)

- Seed smear control (handling without electrochemistry)

- Electrically insulated seed (tests "conductive extension" hypothesis)

Triage Patent Portfolio Under April 3 Deadline

All three models flag this. Counsel-driven triage:

- Must-convert: Core SSN (P1) + core apparatus

- Nice-to-have: Speculative 40+ materials expansions

File narrow, defensible claims supported by real data — not broad claims that die on enablement challenges.

Demand Full Raw Data Transparency

GPT produced a detailed diligence request list. Key principle: if they won't show the full run history (not just best runs), assume selection bias.

Keep Tractor Beam as R&D, Not Critical Path

All three agree this is not ready for commercialization. It's an asset, not a product. Don't let it distract from the SSN → battery additive beachhead.

Decision Framework

A structured approach to investment decision-making based on gate criteria and milestone validation.

Cooperation / Transparency Gate

- Complete raw datasets + full run history + full provisionals

- Accept pre-registered controls + independent replication (ECL-style)

If NO: WALK (assume selection bias / story-first culture)

SSN Mechanism Proof on Gold

- ≥3σ off-seed metric exceeds control on ≥1 pulse recipe

- Reproduced on ≥2 independent electrodes

- Ring seeds outperform disks on off-seed metric

- Strongly preferred: ¹³CO₂ incorporation evidence

If FAIL: One remediation loop max. If still fail → WALK

Copper Viability ("Copper Cliff")

- Demonstrate propagation metric on copper substrate

- Or scalable non-noble interface

If FAIL: Usually WALK for battery thesis (unless pivoting to premium/noble-substrate-only market)

Purity & DSP Economics

- Document as-grown purity, DSP yields, waste costs

- Show COGS not dominated by cleanup

Investment Recommendation: Option-to-acquire until Gates 1-3 clear, then full acquisition if AI integration potential validated

Critical Due Diligence Requests

GPT-5.2 Pro's comprehensive diligence package designed to kill false positives and surface IP/ownership problems.

SSN "Gate 1" Raw Data Package

Full run log for every SSN experiment to date (not just best runs). For each run, demand:

- Unique run ID, date/time, operator

- Cell schematic + photos, electrode geometry

- Substrate prep SOP with timestamps

- Electrolyte recipe (all chemicals, vendors, lots)

- CO₂ delivery: mass-flow controller logs

- Waveform files: exact pulse recipe

- Raw Raman mapping package per pixel

If they won't show full run history, assume selection bias.

Critical Controls (Pre-registered)

Gas/control controls:

- CO₂ vs N₂/Ar vs no gas flow

- Cylinder + MFC only (no dry ice)

Seed/pulse controls:

- DC vs pulsed at matched current

- No seed + identical pulsing

- Electrically insulated seed

The game-changer:

IP / Legal Diligence Package

Time-critical (7 weeks to April 3, 2026):

- Copies of all 8 provisional applications (full text)

- Exact April 3, 2026 family detail

- Inventor list + signed assignment agreements

- Lab notebooks / ELN exports supporting filings

- All MTAs / SRAs / NDAs with universities

- Concrete conversion plan with defensible claim scope

Critical: "Prophetic until validated" means current IP may be thin where it matters.

Tractor Beam Evidence Package

Request unedited videos of complete process:

- Shear event → capture/hold → placement

- Environment: air vs vacuum, humidity range

- Sheet metrology after placement

- Yield metrics: % successful single-layer pulls

- Field parameters: voltage ranges, arcing events

If they can't produce this package, treat Tractor Beam as "concept art," not an asset.

The Feral Labs Thesis

The disagreements between models surface nuances that no single analyst would catch. This is what Feral Labs does for portfolio companies. Not advice. Not decks. Infrastructure that thinks.

Murat — you and Mati have the full data room context. We have the analytical firepower. The combination is the point.

Next Step

Gate 1 at ECL. Let's make the science talk.